If you are a newcomer to the world of investing in precious metals, you’ve probably seen some terms like “investment grade” or “numismatics” being used when referring to these metals. Just what do those terms mean and how do they impact your decisions about where and what to investment to make is our topic today.

It’s pretty simple really, precious metals are ‘graded’ using a number of different methods and these terms refer to that grading. Precious metals are typically graded by a third-party grading service based on the quality and purity of the precious metal and ensure you of its of proper quality for investment.

There are three commonly used grades for precious metals:

- Investment

- Bullion

- Numismatic

Investment grade metals are of the highest quality and typically produced through government-approved mints. They are typically sold as bars or coins and are stamped for authenticity. It is thought to be the most popular investment as it is of the highest quality, easier to liquidate and retains its value over time.

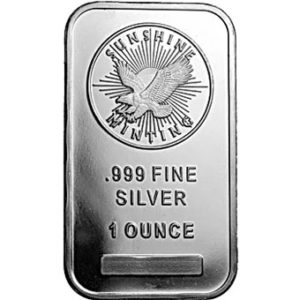

Bullion may be of slightly lower purity than investment grade and produced by a variety of parties. It is still suitable for a long term investment for storing wealth and is typically sold in bars, coins and rounds. It is easy to liquidate, making it a favorite among investors.

Numismatics are coins or bars with a collectible value – rare or old coins. These coins or bars are of a higher grade and will carry a higher premium. As collectibles, they may also have historical significance and be highly sought after. These coins typically command a price higher than spot price, but they carry additional risk as their value is dependent upon the rarity, condition and demand for the coin.

Some examples of each:

Investment: The Perth Mint – Australian Spotted Eagle Ray

The Australian quarter ounce gold piece is a bullion coin format. The design features the Spotted Eagle Ray and was issued in several formats by the Perth Mint of Australia.

Silver bars, commonly referred to as ingots, are privately minted assets typically purchased by investors in 1 oz., 10 oz., or 100 oz. increments. These bars are privately minted by a variety of companies such as Engelhard, Johnson Matthey, and Credit Suisse among other and come with a wide range of designs and mint marks.

Numismatic: American Gold Eagle Proof

Each year the U.S. Mint issues collector versions of the American Gold Eagle, referred to as “Proofs”. Every proof coin is handled with meticulous care and struck several times to give it a flawless, mirror-like appearance. Each of the American Gold Eagle Proof 1 oz Coins comes with beautiful packaging from the mint.

Which of these precious metals you should invest in is obviously a personal decision and should be based on your investment goals and tolerance for risk. Before investing in precious metals, or any type of investment, do your homework, research the market and the company you plan to work with, talk to your financial advisor and discuss the investment with your family.

Our Specialists at Vaultus Gold would be happy to introduce you to the world of precious metals.

Call us at 866-511-4653