If you are like many people in this country, you are feeling are skeptical about the economy and concerned that we will soon slip into a recession. Many experts agree.

A recent article in the Wall Street Journal reports that “more than two-thirds of the economists at 23 large financial institutions that do business directly with the Federal Reserve are betting the U.S. will have a recession in 2023. Two others are predicting a recession in 2024.

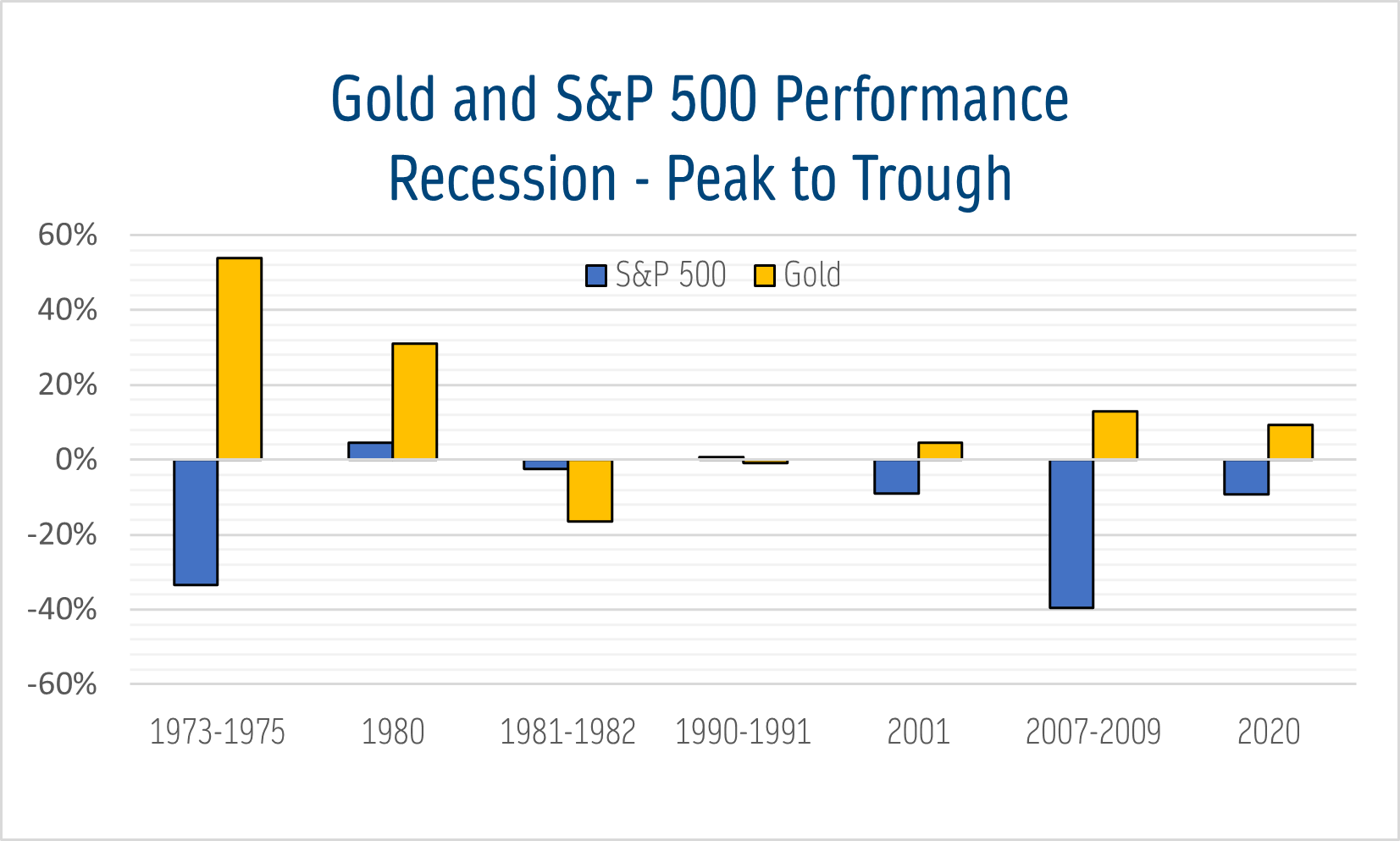

Glum predictions, no doubt. We can’t say for sure if these economists will be proven prescient, but we can examine past recessions and see how gold had performed compared to the broad U.S. stock market. It turns out that during times of economic contraction, gold out-performs the stock market and therefore, gold can help secure your wealth during recessions. Let’s look at the data.

During recessions occurring since the 1973-1975 cycle, the average price change in Gold was + 13.5%, compared to – 12.6% price change for the S&P 500.

That is a massive difference in returns and a good reason to look into an investment in gold for your portfolio.

However, a combination of high inflation, inverted yield curves, undisciplined fiscal policies, and high taxes point to that inevitability. How prepared are you to weather the storm?